Early Retirement

The practice of leaving employment before the statutory age, especially on favorable financial terms.

I am sure your vision of retirement and my vision of retirement aren't the same. Retirement is completely different for each person because of how people view and perceive work, money, and time. With that being said, the one commonality is that "every person should live the life they want and not a life they feel they are forced to live."

That quote sums up my view on retirement because I enjoy working, find meaning in what I do, and truly feel like I bring a strong value and purpose to those I work with (colleagues) and for (my students). I have no desire to retire right now, however I want to know that I am giving myself options for later on in my life. You never know when your perspective on life (YOLO) will change, when you spark a new passion, or even when you have outgrown your current employment so it is good to have options for if/when those things happen!

I read a long time ago that when you save or invest your "younger self" is setting up your "older self" for success and that concept stuck with me. That is all retirement really is. Some people set themselves for it up sooner and some later. Ultimately, the choice is yours on what retirement looks like to you.

What does your retirement look like?

That quote sums up my view on retirement because I enjoy working, find meaning in what I do, and truly feel like I bring a strong value and purpose to those I work with (colleagues) and for (my students). I have no desire to retire right now, however I want to know that I am giving myself options for later on in my life. You never know when your perspective on life (YOLO) will change, when you spark a new passion, or even when you have outgrown your current employment so it is good to have options for if/when those things happen!

I read a long time ago that when you save or invest your "younger self" is setting up your "older self" for success and that concept stuck with me. That is all retirement really is. Some people set themselves for it up sooner and some later. Ultimately, the choice is yours on what retirement looks like to you.

What does your retirement look like?

Teachers and Retirement Plans

I came across this eye-opening article about retirement years ago and ever since I have made it my mission to make the strongest financial decisions. I wanted to create my own financial freedom and more importantly break the chains of what so many teachers have experienced before me when it comes to retirement and planning. I highly recommend giving it a read and make it a strong point to reflect on your own planning. Start asking questions yesterday!

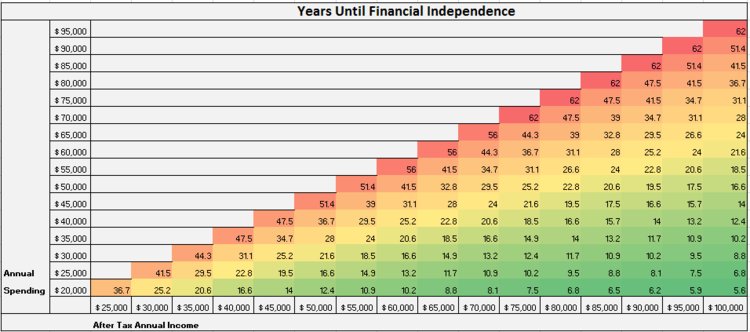

The 25X Rule

(How much you will need)

The 25X Multiplier Rule refers to your desired annual income (how much you want every year in retirement) by 25.

Example: You want to make $40,000 a year then you would take 25x that number and you would need $1,000,000

Example: You want to make $40,000 a year then you would take 25x that number and you would need $1,000,000

The 4% Rule

(How much you can withdrawal from Your Portfolio)

The 4% Rule basically refers to the Withdrawal Rate of your money.

Example: If you have $100,000 you would be able to take 4% ($4,000) and your money would last more than 25 + years depending on portfolio allocation.

Example: If you have $100,000 you would be able to take 4% ($4,000) and your money would last more than 25 + years depending on portfolio allocation.

Simple Math to Early Retirement

How much do I need for retirement

Choose which Retirement Calculator works best for you below

Kiplinger's |

Personal Capital |

Vanguard |

How much do I need to retire guide

This resource is from lendedu and it lists factors to help you determine the amount of money you'll need in retirement, sources of retirement income, and the importance of budgeting for your financial future. Take a read!

The 10 Commandments of Retirement

1. If your preretirement lifestyle is set with a view to what you can sustain after you quit the workforce, you’re likely on track. If not, retirement could mean a sharp drop in living standards.

2. Remember that Social Security is designed to replace no more than 40% of preretirement income—and for many, that 40% is an overestimate, because the benefit calculation is skewed toward lower income Americans. In retirement, you’ll want some steady sources of income, and Social Security is probably the most secure. But recognize that it’s intended to be a minor part of your total income.

3. Have a financial and estate plan that provides for your spouse and any others who depend on you financially—and who may outlive you. Income annuities, investment income streams and life insurance might all be part of that plan.

4. Never forget the non-financial aspects of your retirement are important, too. Think about any significant relocation long before you retire—and consider trying it out first. It’s a big mistake to think of retirement purely as leisure time. And remember, when it comes to the fun stuff, that takes money.

5. Pay attention to communications from your employer, Social Security, Medicare, personal advisers and others. What you don’t know can hurt you. A missed deadline and any number of other goofs can do severe financial damage.

6. Put retirement savings ahead of other goals, like college or a vacation home. Unless you have a good pension plus Social Security, it’s mostly up to you—and there are no second chances.

7. Save as much as possible as soon as possible. You can always reduce your savings rate later. Investment compounding really is powerful. Load up on savings early in your career and let the money work for you in the decades that follow. When money gets tight, such as when paying for the kids’ college, you may need to trim savings for a few years. But if you over-saved during the first 10 years or so of your career, you will likely still reach retirement in good shape.

8. Recognize that your taxes may not be lower during retirement. All the signs point to higher taxes in the future for everyone. To reduce my retirement tax bill, I favor Roth accounts and municipal bond mutual funds.

9. Place health care high on your list of fixed expenses. Medicare plus supplemental insurance can cost a retired couple more than $700 a month. Even if you’re fortunate not to need much medical care, those premiums are a big monthly hit and they’ll grow each year. Prescription drugs can also be a large expense. What if you aren’t so fortunate? Remember that Medicare has no out-of-pocket limits.

10. Invest in ways that will provide a steady income stream in retirement. In many ways, retirement is no different from your working years: You want a steady flow of income. Do not be totally exposed to stock market fluctuations. You don’t want to worry about where that 4% withdrawal rate will come from each year.

Article by: Richard Quinn blogs at QuinnsCommentary.com.

2. Remember that Social Security is designed to replace no more than 40% of preretirement income—and for many, that 40% is an overestimate, because the benefit calculation is skewed toward lower income Americans. In retirement, you’ll want some steady sources of income, and Social Security is probably the most secure. But recognize that it’s intended to be a minor part of your total income.

3. Have a financial and estate plan that provides for your spouse and any others who depend on you financially—and who may outlive you. Income annuities, investment income streams and life insurance might all be part of that plan.

4. Never forget the non-financial aspects of your retirement are important, too. Think about any significant relocation long before you retire—and consider trying it out first. It’s a big mistake to think of retirement purely as leisure time. And remember, when it comes to the fun stuff, that takes money.

5. Pay attention to communications from your employer, Social Security, Medicare, personal advisers and others. What you don’t know can hurt you. A missed deadline and any number of other goofs can do severe financial damage.

6. Put retirement savings ahead of other goals, like college or a vacation home. Unless you have a good pension plus Social Security, it’s mostly up to you—and there are no second chances.

7. Save as much as possible as soon as possible. You can always reduce your savings rate later. Investment compounding really is powerful. Load up on savings early in your career and let the money work for you in the decades that follow. When money gets tight, such as when paying for the kids’ college, you may need to trim savings for a few years. But if you over-saved during the first 10 years or so of your career, you will likely still reach retirement in good shape.

8. Recognize that your taxes may not be lower during retirement. All the signs point to higher taxes in the future for everyone. To reduce my retirement tax bill, I favor Roth accounts and municipal bond mutual funds.

9. Place health care high on your list of fixed expenses. Medicare plus supplemental insurance can cost a retired couple more than $700 a month. Even if you’re fortunate not to need much medical care, those premiums are a big monthly hit and they’ll grow each year. Prescription drugs can also be a large expense. What if you aren’t so fortunate? Remember that Medicare has no out-of-pocket limits.

10. Invest in ways that will provide a steady income stream in retirement. In many ways, retirement is no different from your working years: You want a steady flow of income. Do not be totally exposed to stock market fluctuations. You don’t want to worry about where that 4% withdrawal rate will come from each year.

Article by: Richard Quinn blogs at QuinnsCommentary.com.

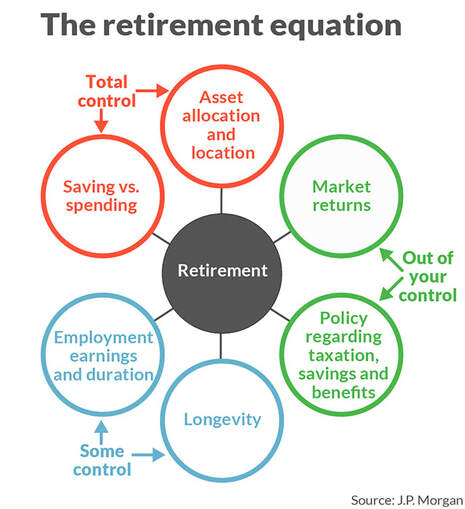

Racing to Retirement

(In) and Out of your control

Want even More on early retirement

Financial Independence, Retire Early

The Fire Community

“Financial Independence, Retire Early”

Hottest FIRE Blogs

Fire or FiE?

Feed your FIRE!

How big is your FIRE?

Getting there 1 step at a time

Why so much hate for Early Retirement?

Life=Risk

Bankrate FIRE Guide

Bankrate reached out to me after seeing my website (I know, I know, Bankrate saw my website!) and wanted to share a resource they created that they felt my readers would benefit from. I am a huge fan of their site and have some of their resources sprinkled throughout my pages on wealth and money.

Their easy to follow and understand guide provides a number of tips that FIRE members would find helpful, including how to:

Cut spending and generate additional income

Rebalance their financial portfolio to adapt to a changing economy

Create a reserve cash cushion

So take a look and thanks Bankrate for the solid info!

Their easy to follow and understand guide provides a number of tips that FIRE members would find helpful, including how to:

Cut spending and generate additional income

Rebalance their financial portfolio to adapt to a changing economy

Create a reserve cash cushion

So take a look and thanks Bankrate for the solid info!