Creating Wealth

This section under Personal Empowerment was set-up in the following way to show the progression (at least how I view it) when it comes to Money, Freedom, and Happiness. It starts with Smart Money (learning the skills and strategies to being smart with money), Investing (making your money work for you), Passive Income (creating multiple sources of income), Early Retirement (living the life you want on your time) and Travel (filling your time with whatever you choose)!

PE Site about Money?

I have a passion for all of these areas in life and I primarily created this section to help anyone/other educators educate themselves on how to create their own wealth. We spend so much time giving our time, efforts, and energy to our students that we often time forget to take care of ourselves physically, mentally, emotionally, and financially. There aren't enough hours in the day to learn about it all, however with an article here, or a conversation there, we can start to empower ourselves into a direction that is filled with choice, independence, and most importantly freedom to live the life we envision for ourselves.

How exercise is like investing

Power of Money

My Money Guide

Before I read anything regarding wealth, finance or investments I always remember the 8 Rules that lay the foundation regarding money. The Richest Man in Babylon is my first guide when it comes money, saving, and investing and I highly recommend it! The tabs in this section will help you understand Smart Money, Investing, and also ways to create Passive Income on your path to Financial Freedom! I am a firm believer in making "money your servant, and not your master." Building wealth is about building freedom and living the life you want instead of a life you are forced to live.

The 8 Rules in The Richest Man of Babylon

1. Pay Yourself First

(“Start thy purse to fattening.”)

2. Live below your means

(“Control thy expenditures.”)

3. Make our money work for you

(“Make thy gold multiply.”)

4. Insurance protects your wealth

(“Guard they treasures from loss.”)

5. Your home is our biggest expense

(“Make of they dwelling a profitable investment”)

6. Have a retirement plan.

(“Insure a future income.”)

7. Invest in yourselves.

(“Increase thy ability to earn.”)

8. Track your Wealth.

(Know where you are and where you are going.)

(“Start thy purse to fattening.”)

2. Live below your means

(“Control thy expenditures.”)

3. Make our money work for you

(“Make thy gold multiply.”)

4. Insurance protects your wealth

(“Guard they treasures from loss.”)

5. Your home is our biggest expense

(“Make of they dwelling a profitable investment”)

6. Have a retirement plan.

(“Insure a future income.”)

7. Invest in yourselves.

(“Increase thy ability to earn.”)

8. Track your Wealth.

(Know where you are and where you are going.)

Free Income and Expense Tracking Excel Spreadsheet

| mr_clarks_income_expense_chart_template_.xlsx | |

| File Size: | 386 kb |

| File Type: | xlsx |

Knowledge is Power! (and Money)

Investor.gov is a free online resource that will help you learn, understand, and guide you with making sound investment decisions and avoid fraud and deceit.

Personal Capital is a comprehensive one-stop shop when it comes to helping you track your income, expenses, and net worth. Simply connect your bank accounts, credit cards, mortgages, loans, and your assets and watch a personalized financial dashboard fill up with a story of your overall finances.

Blooom brings that extra sense of security when it comes to investing and retirement. They believe that financial help should be smart and simple for all Americans! Their bread and butter is to guide an investor to the best funds with the lowest fees. These guys rock!

Your Money or Your Life is a website/platform partnership created by Vicki Robin (Author of Your Money or Your Life) and Grant Sabatier (Founder of Millennial Money). They offer a Life Energy Calculator where you can see your real hourly wage. Give it a try and check out some of their other solid resources, and community forum.

Wisebread is a solid website that helps users find frugal ways to save money, offers creative life/money hacks and also highlights 100 of their PF Top Finance Blogs . Get yourself a slice of WiseBread today! (Whole-wheat of course)

Kiplinger is a publisher of personal finance advice, business forecasts and available in print and online that focuses on wealth creation, investing, retirement, taxes, your money and your business. I am a huge fan of their magazine and find myself reading it cover to finish in one sitting.

Nerdwallet offers solid insight into the top credit card companies, banks, mortgages/loans, and investments. They also have an extensive scroll down list of: Best Of's, Comparisons, Reviews, and Read and Learn making them an awesome library of financial knowledge and power!

The Motley Fool is a multimedia financial-services company that provides financial advice for investors through various stock, investing, and personal finance strategies, stories, and services. 13 Steps on How to Invest Foolishly!

Morningstar was/and still is one of the main online websites I use to learn and research stocks, etf's, and mutual funds. I use it in my arsenal of investing tools when I am right in the thick of investing. I love that they are an independent investment research company offering mutual fund, ETF, and stock analysis, ratings, and data/portfolio tools. I give them 5 out of 5 stars because you simply type in any investment and they give you a financial overview/information with a star'd rating of the investment.

US News and World Report offers it's Best Fit rankings to identify stocks, etf's and mutual funds that perform reliably and could function well as part of an investor’s long-term asset allocation plan. Go check it out by Funds or Rankings! This site is a great help to me when I explore and want to learn more about what to put in my portfolio.

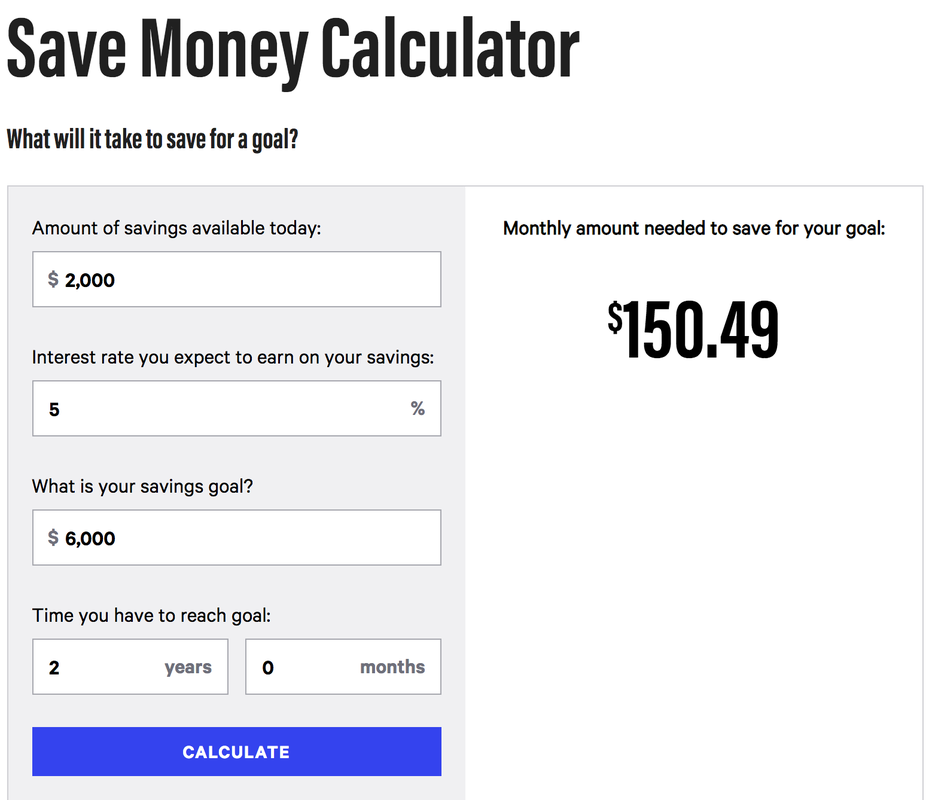

Bankrate is like the ultimate financial calculator. Check out all the calculators when it comes to mortgage, banking, credit card, auto, loans, investing and personal finance. It offers free tools, expert analysis, and award-winning content to make smarter financial decisions

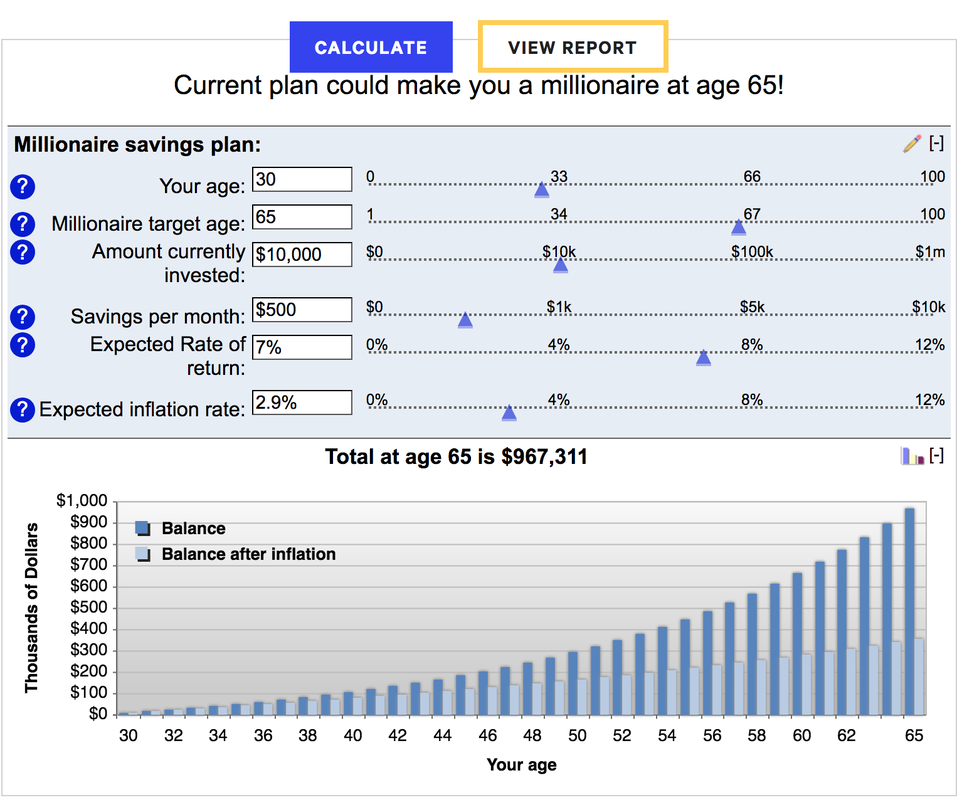

Million Dollar Calculator

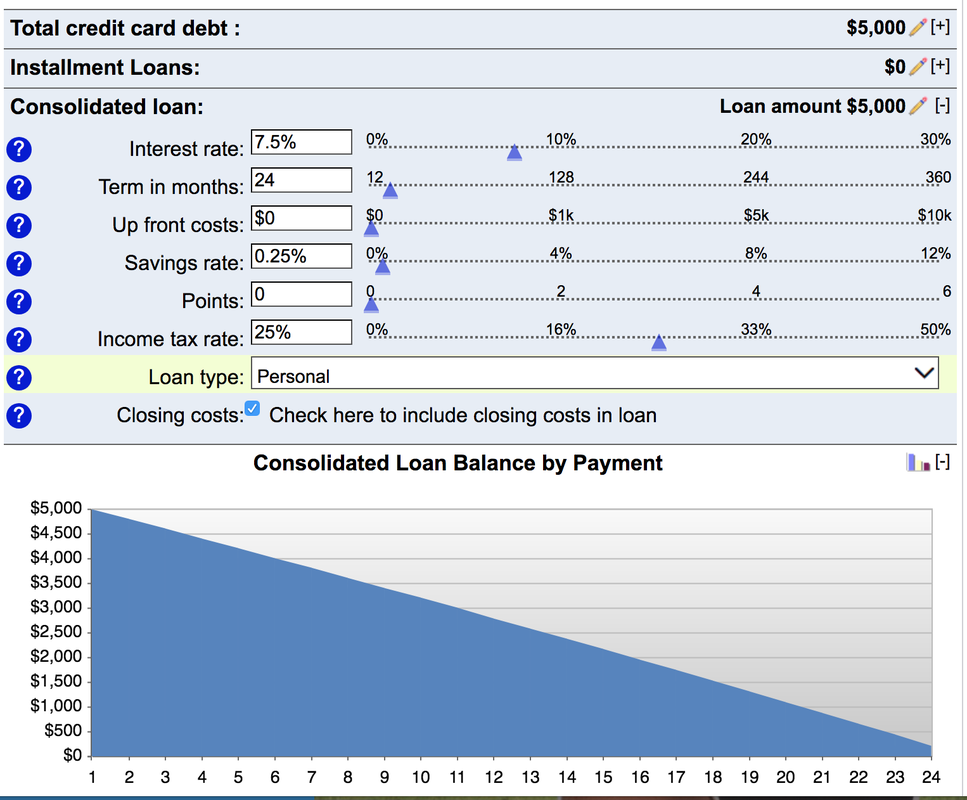

Debt Calculator

Savings Calculator

Investopedia is the world's leading source of financial educational website in the world! Play Stock Market the Game and get your kids practicing with play money before they earn those Benjamins!

Rockstar Finance is jam-packed with finance from a Rockstar Money Forum, Directory, Community Fund, to an Rockstar Money Challenges. I love the unorthodox approach of writing on this site. Just check out: (Why I Fire'd Myself from Rockstar Finance)

The Penny Hoarder is one of the largest personal finance websites and it does just what it's name suggests. It finds you awesome ways to help readers save money through conventional and unorthodox ways.

The College Investor is a solid place to help students learn about, understand, and conquer student loan debt while starting their adventure toward financial stability and success! Educators across the world should definitely explore this site!

Chris Reining- I stumbled across this site and immediately loved his unorthodox and witty approach to financial freedom and investing. His "Ask Chris" section is brilliant and I love the simplicity and easy to understand answers he provides.